Horoscopes have captivated people’s imagination for centuries. Many believe that the celestial bodies’ positions at the time of their birth can influence their personalities and life paths. For those who find solace in the stars, horoscopes offer insight, guidance, and a sense of connection with the universe. In this article, we’ll delve into the world of horoscope generator PDFs, shedding light on how they work and their benefits.

Table of Contents

What Is a Horoscope Generator?

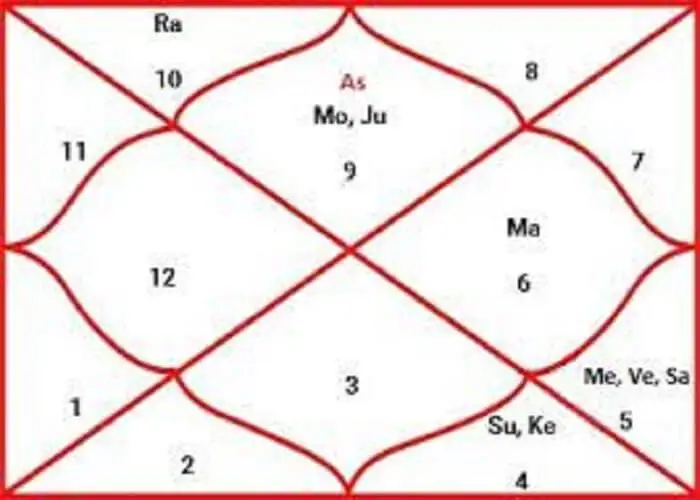

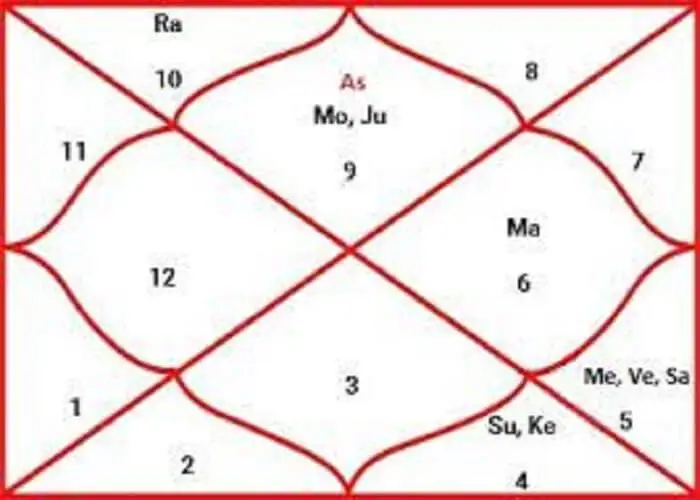

Horoscope generators are fascinating tools that provide personalized astrological insights. They take your birthdate, time, and place into account, creating a unique snapshot of the celestial positions at that moment. This snapshot is then used to generate a horoscope that can offer guidance and perspective on various aspects of your life.

How Do Horoscope Generators Work?

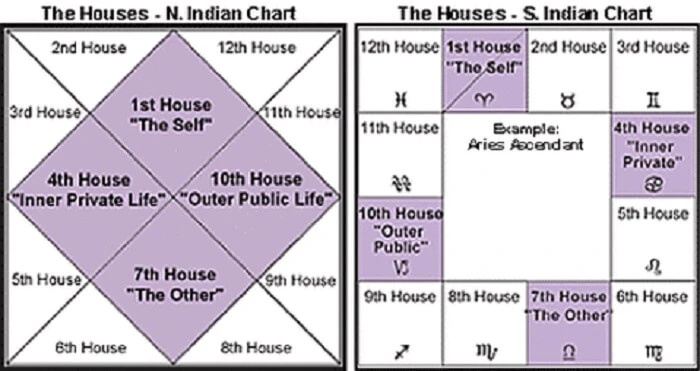

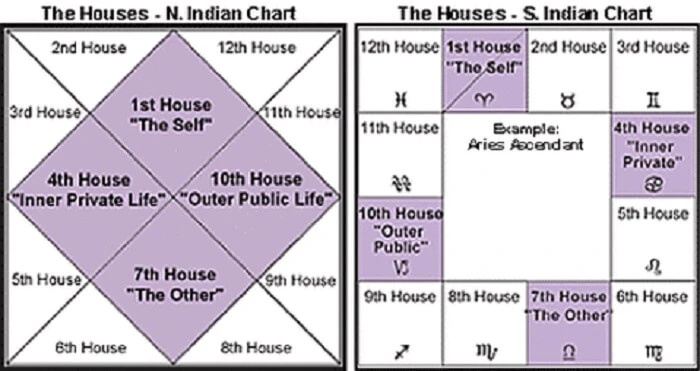

The magic behind horoscope generators lies in complex algorithms and extensive data sources. They analyze planetary positions, astrological houses, and other factors, distilling this information into a comprehensible horoscope. This process ensures that each horoscope is tailored to the individual, offering specific insights and advice.

Benefits of Using a Horoscope Generator PDF

One of the great advantages of using a horoscope generator in PDF format is convenience. PDFs are easily accessible on various devices, making it simple to check your horoscope wherever you are. Whether you’re at home or on the go, you can have your celestial guidance right at your fingertips.

Customization Options

Not all horoscopes are created equal. Horoscope generators allow you to customize your readings to your specific preferences. You can focus on your sun sign, moon sign, or rising sign, depending on your interests. This level of personalization ensures that the advice you receive is relevant and meaningful to you.

Astrology and Personal Growth

Horoscopes have the potential to contribute to personal growth. By reflecting on the insights they offer, individuals can gain a better understanding of themselves and their life’s direction. Astrology encourages self-reflection and personal development, making it a valuable tool for those seeking self-improvement.

Finding Reliable Horoscope Generators

To make the most of your horoscope experience, it’s essential to choose a reliable horoscope generator. Look for platforms that use accurate astrological data and maintain a good reputation within the astrology community. This ensures that the insights you receive are trustworthy and relevant.

Downloading Your Horoscope PDF

Generating and downloading your horoscope in PDF format is a straightforward process. Most horoscope generator websites provide clear instructions, guiding you through the steps. You’ll have your personalized horoscope ready to consult in no time.

Compatibility and Love Horoscopes

For those interested in matters of the heart, love horoscopes and compatibility readings are readily available. These horoscopes provide insights into your compatibility with a potential partner, helping you make informed decisions in your love life.

Daily, Weekly, and Monthly Horoscopes

Horoscope generators offer various types of readings, from daily horoscopes to monthly forecasts. These provide you with different perspectives on your life, allowing you to navigate your path more consciously.

The Role of Zodiac Signs

Understanding the 12 zodiac signs and their characteristics is fundamental to interpreting your horoscope. Each sign has distinct qualities that influence the advice provided in your reading. By knowing your sun, moon, and rising signs, you can gain a more comprehensive understanding of yourself.

Exploring Astrology in Depth

If you’re intrigued by astrology, you can explore this fascinating field more deeply. There are numerous resources available, including books, courses, and websites, to help you dive into the complexities of astrological science.

Testimonials and User Experiences

Hearing from others who have found value in horoscope generators can be inspiring. Many individuals have shared their positive experiences and how horoscopes have positively impacted their lives. These testimonials are a testament to the power of astrology.

Ethics and Responsibility

It’s important to approach astrology and horoscopes with respect and responsibility. While they can offer guidance, they should not be used to make critical life decisions. It’s essential to remember that they are one of many tools for self-reflection.

Conclusion

Horoscope generator PDFs open the door to the mysteries of the universe, providing personalized insights and guidance. They offer a unique way to connect with the celestial world and explore the depths of your personality. So, why not give it a try and see where your celestial path leads you?

FAQs

Are horoscope generator PDFs accurate?

Horoscope generators strive to provide accurate insights, but the interpretation is subjective. Use them as a tool for self-reflection, not as a definitive guide.

Can I trust horoscope compatibility readings?

Compatibility readings can offer insights into your relationships, but remember that they are based on general astrological principles and should be taken with a grain of salt.

Is there a specific time of day to generate a horoscope?

While generating a horoscope at the exact time of your birth is ideal, most horoscope generators can provide meaningful insights with your birth date alone.

How often should I check my horoscope?

The frequency of checking your horoscope is a personal choice. Some check it daily, while others prefer weekly or monthly readings.

Can horoscopes predict the future?

Horoscopes provide guidance and insights, but they do not predict specific future events. Use them as a tool for self-awareness and personal growth.